Four good reasons for a price floor in emissions trading

A new study highlights the need for action on the part of the new EU Commission and explains why the recent reforms are not sufficient.

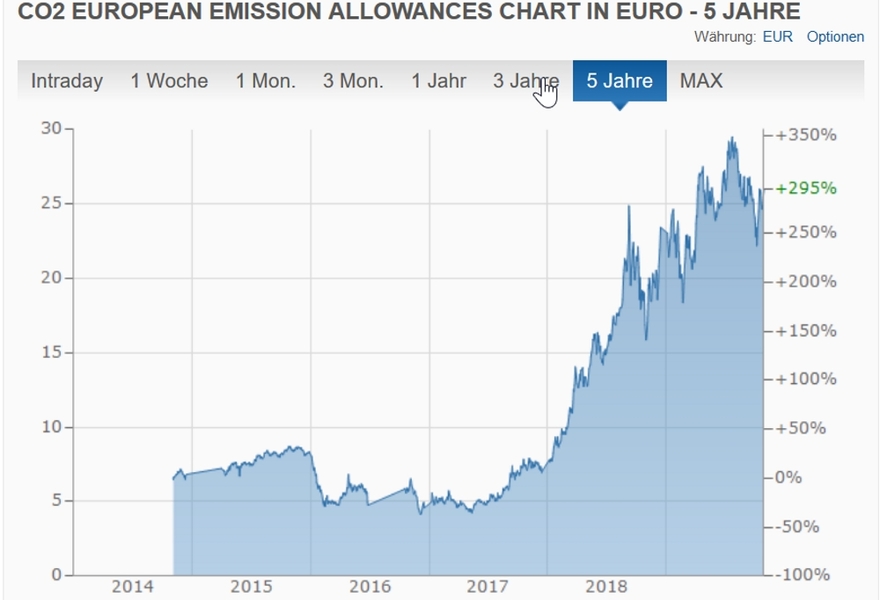

Merely a speculation bubble? The price per tonne of CO2 in the EU Emissions Trading System has recently increased. | Photo: Finanzen.net

When the new EU Commission starts in December under Ursula von der Leyen, climate policy will be high on the agenda. About half of greenhouse gas emissions have been limited by the European Emissions Trading System (EU ETS) since 2005 – and after prices for emission allowances have been extremely low for a very long time, they are finally at a significantly higher level since 2018. However, if the EU ETS is to provide effective incentives for investment in carbon-free technologies, it needs a minimum price as soon as possible. This was demonstrated by a new study carried out with the participation of the Berlin-based climate research institute MCC (Mercator Research Institute on Global Commons and Climate Change). The study has now been published in the renowned journal Climate Policy.

The team of authors from five countries analysed the scientific literature on the effectiveness of emissions trading systems and discussed it in several workshops with experts from science, politics, industry, and NGOs. According to the study, it cannot be ruled out that the current price of 25 to 30 euros per tonne of CO2 might merely reflect a speculative bubble. Thus, the price could collapse again– for example, if individual governments decide on additional measures to reduce carbon emissions and thus the demand for emission allowances.

“We are demonstrating that the reforms to date, and in particular the instrument of the Market Stability Reserve, are not sufficient to make European emissions trading truly effective”, explains MCC Director <link en institute team edenhofer-ottmar.html>Ottmar Edenhofer, one of the authors of the study. “For example, due to the way the instrument has been structured so far, the German coal phase-out could have the absurd consequence that it does not reduce carbon emissions on a European scale, but instead increases them.”

The study systematically deals with possible objections to a minimum price and provides the new EU Commission with four arguments for immediate action. First, certificate prices might fall significantly even again after the introduction of the Market Stability Reserve, the mechanism cannot reliably stabilise price expectations. Second, according to the latest scientific research, a hybrid instrument consisting of quantity control and a price floor is superior to pure quantity control. Third, despite frequent claims, the principle of unanimity in the EU Council, which applies for tax issues, does not apply to a minimum price in the emissions trading system. Fourth, even an initial price floor below the current market level would be an important signal for investment decisions.

“The next opportunity for action is the review of the Market Stability Reserve in 2021”, says Edenhofer. “After France, the Netherlands, Sweden, Portugal and Spain, Germany has also recently come out in favour of such a reform. It’s important that Brussels addresses this issue now.”

Reference of the cited article:

Flachsland, C., Pahle, M., Burtraw, D., Edenhofer, O., Elkerbout, M., Fischer, C., Tietjen, O., Zetterberg, L., 2019, How to avoid history repeating itself: the case for an EU Emissions Trading System (EU ETS) price floor revisited, Climate Policy

https://doi.org/10.1080/14693062.2019.1682494